After two days of sharp declines in its share price, technology services group EOH on Friday issued a “voluntary announcement” on the JSE’s stock exchange news service punting its public sector business.

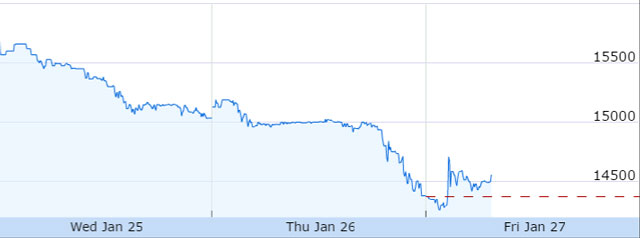

EOH tumbled more than 8% in two trading sessions on Wednesday and Thursday as investors fretted that one of the JSE’s growth stories of the past decade might be losing a little steam. (EOH’s interim financial period ends on 31 January, with results for the six months expected in March.)

Its share price tumbled from R157,25 on Tuesday to R143,75 by Thursday’s close, a decline of 8,6%. In the past year, the share has added 12,8%, while over three years it’s up by 76,4%.

But EOH has moved to dispel speculation that its growth prospects have dimmed.

“EOH continues to be a strong, healthy organisation, successfully pursuing its stated growth strategy which is based on expanding into new territories, new products and services, new industries and developing and marketing its own [intellectual property] solutions internationally,” the group told shareholders via the voluntary statement.

It said it has made a number of acquisitions in the e-government solutions space in the Middle East. It has also won government contracts from the City of Johannesburg and the City of Cape Town.

“The pipeline for EOH e-government solutions is very strong, with large-scale opportunities in East and West Africa, the UAE, Egypt, Morocco, Saudi Arabia, Malaysia and Indonesia,” it said.

Also in a stock exchange news service statement on Friday, EOH said director John King had acquired 2 200 shares at an average price of R145,54/share for roughly R320 000, suggesting that management remains confident in the business.

Irnest Kaplan, MD of Kaplan Equity Analysts, said EOH remains a solid business with good growth prospects, despite the fact that the share price has trod water for the past two years. It continues to trade at a healthy multiple of 21,8x trailing earnings.

“The results for the past two years have been phenomenal,” Kaplan said. The fact that the shares have been under pressure suggests more that investors had become “overly exuberant” rather than there being anything fundamentally wrong at the group.

He said when EOH reports its next set of results in March, they’ll again “probably be fairly good” and the share price will probably “go up a bit”.

However, investors should not expect the performance of the past five years to be repeated over the next five years, purely because EOH is now a large company and growing off a large base is more difficult, Kaplan said. “But I don’t think the share price is going to fall out of bed either.”

He said there is “nothing” wrong at EOH. “If there is, I certainly haven’t seen it.” — (c) 2017 NewsCentral Media