Tap-on-phone technology and peer-to-peer (P2P) payments are two different methods of facilitating financial transactions, but they share some similarities in terms of their convenience and accessibility.

Tap-on-phone technology and peer-to-peer (P2P) payments are two different methods of facilitating financial transactions, but they share some similarities in terms of their convenience and accessibility.

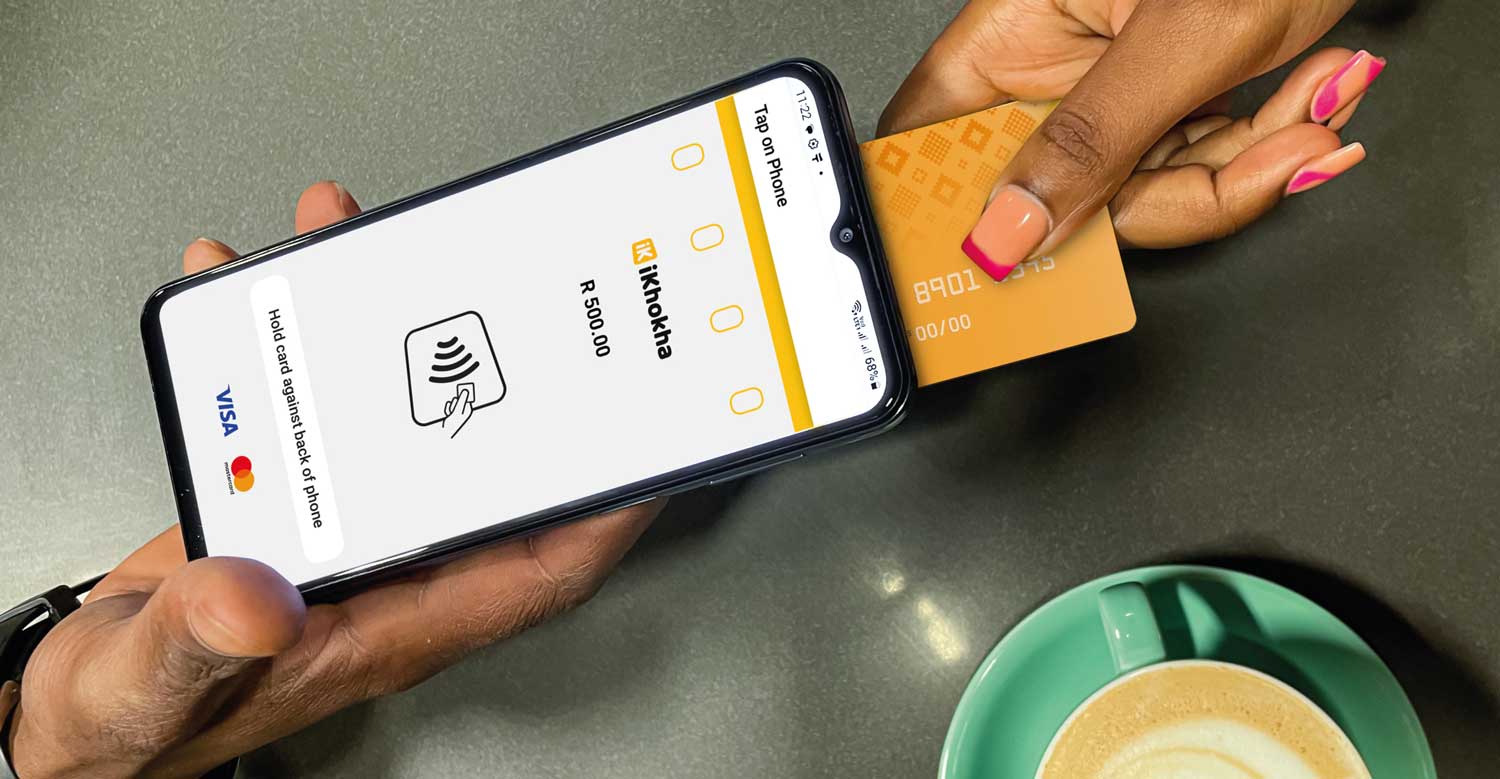

Tap-on-phone technology refers to a contactless payment method that enables customers to make payments using a mobile phone as a point-of-sale (POS) device. The merchant’s mobile phone is used as a card reader, allowing customers to tap their contactless card on the phone to make a payment.

This technology is gaining popularity in South Africa, where it is being adopted by small businesses and merchants as an alternative to traditional POS devices.

P2P payments, on the other hand, are transactions between individuals who use mobile apps or online platforms to send money to one another.

These transactions can be initiated from a bank account or a digital wallet. P2P payment platforms are also gaining popularity in South Africa, where they are used for various purposes, including splitting bills, paying for goods and services, and sending money to family and friends.

When comparing tap-on-phone technology with P2P payments, there are some notable differences. Tap-on-phone technology is primarily used by merchants to accept payments, while P2P payments are used by individuals to send and receive money.

If you’re running a business, here are five reasons why tap-on-phone technology is the best low-cost payment option for your business.

1. No maximum transfer

A key difference between the two offerings is the maximum transfer amount. P2P payments are often capped with leading South African providers limiting transactions to R3 000. However, with tap-on-phone transactions there are no limits.

2. Available to any bank

Currently, P2P is only available through selected banks, namely FNB, Standard Bank, Absa and Nedbank. Tap on phone on the other hand can accept payments using any South African bank card.

3. Customers don’t need an app

With P2P payments, both parties need to have registered for the service via their banking app to conduct a payment. With tap-on-phone technology, the merchant’s app facilitates the transaction using the customer’s bank card, which removes a possible barrier to payment.

4. Process refunds

Card-based transactions through POS devices (including tap-on-phone technology) allow businesses to process refunds, which increases professionalism and customer satisfaction.

5. Access to funding

Providers like iKhokha offer easier access to business funding when compared to traditional bank loans. With iKhokha’ s iK Tap on Phone, merchants can start selling with no upfront investment in POS hardware and access working capital after just three months of trading.

Find out more about iK Tap on Phone at www.ikhokha.com.

- Read more articles by iKhokha on TechCentral

- This promoted content was paid for by the party concerned