A tier-one retailer in South Africa focused on fashion clothing, footwear, cosmetics and accessories has adopted a proactive approach to fraud prevention across its retail network in the country – implementing the ReconAssist reconciliation software solution from Ecentric Payment Systems, an omnichannel payments solution partner for business across Africa.

A tier-one retailer in South Africa focused on fashion clothing, footwear, cosmetics and accessories has adopted a proactive approach to fraud prevention across its retail network in the country – implementing the ReconAssist reconciliation software solution from Ecentric Payment Systems, an omnichannel payments solution partner for business across Africa.

According to statistics, members of the Southern African Fraud Prevention Service reported a 600% increase in incidents of fraud in 2022 in South Africa when compared to 2018. According to these estimates, every fraudulent transaction costs 3.51 times the lost transaction value on average. The same research has found that purchase transactions and distribution of funds are most (61%) susceptible to fraud when it comes to the customer journey.

Fraud is therefore a constant challenge that every retailer must deal with. Towards the end of 2019 and early 2020, this retailer recorded losses amounting to roughly R900 000 over six months, which went unaccounted for. This period marked the retailer’s transition to using mobile point-of-sale terminals that are as compact as smartphones.

These devices empowered sales assistants to process payments for customers within the aisles, eliminating the need to queue. Additionally, these terminals equipped store managers with the capability to process card refunds on an ad-hoc basis. For instance, if a transaction was paid for in cash, a manager could refund the amount directly to a customer’s debit or credit card without making them wait.

After the integration of Ecentric’s ReconAssist solution, the retailer identified an unusual surge in the volume of refunds at one of its Durban outlets. This anomaly was pinpointed as the reason behind the significant loss. An internal investigation later uncovered that an employee, in collaboration with external accomplices, had orchestrated these fraudulent refunds. Had this activity persisted undetected, the losses could have escalated to over R1-million within a span of three months.

ReconAssist senior product manager Graham Bradford shed light on the importance of addressing fraud in the retail space. “This is not only to prevent financial losses but also to foster growth and innovation. The ReconAssist solution delivers a robust, proactive and data-driven approach that empowered the retailer to detect and prevent potential threats across its operations.”

‘Complete visibility’

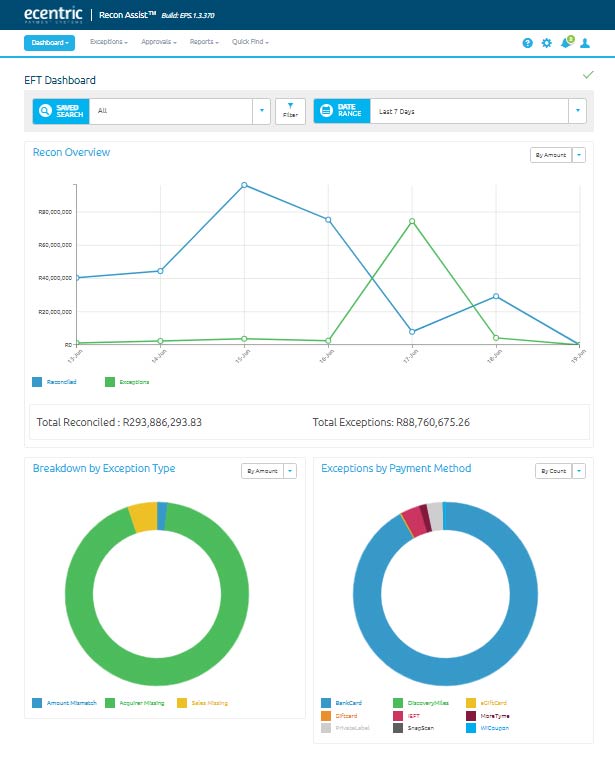

The head of IT operations at the retailer praised the transformative impact of ReconAssist. “The software provided the tools necessary to identify and prevent threats in near real time, offering complete visibility of all transactions throughout the stores and the entire payment ecosystem. The intuitive front-end of the Web-based ReconAssist now enables our financial team to monitor and resolve transactions efficiently, promptly identifying exceptions and any anomalies.”

Given the millions of transactions happening daily at this tier one retailer, ReconAssist came to the fore as it was able to identify the fraud at a transactional level. The software revolutionised the reconciliation process for the retailer, offering continuous reconciliation at transactional levels, and allowed the financial team to focus on other important initiatives while ensuring the entire payment ecosystem worked flawlessly. By accurately detecting anomalies among millions of transactions, the software eliminated guesswork and empowered the retailer to make data-driven decisions for their business planning.

ReconAssist provides retailers of any size with the ability to reconcile refund transactions in isolation. This is critical given that these refunds translates to money leaving the store, regardless of whether it is cash or digital. In 99% of the cases, refunds are performed correctly. However, ReconAssist can identify the 1% of anomalies to highlight a single transaction among millions that is fraudulent.

Bradford emphasised the comprehensive suite of features offered by ReconAssist, including exception management reporting, fees and commission calculations for VAS service providers, and automated postings to most ERPs. The software’s seamless integration across multiple channels, South African acquirers, and third-party service providers like VAS further streamlined finance and operational teams.

Bradford emphasised the comprehensive suite of features offered by ReconAssist, including exception management reporting, fees and commission calculations for VAS service providers, and automated postings to most ERPs. The software’s seamless integration across multiple channels, South African acquirers, and third-party service providers like VAS further streamlined finance and operational teams.

By leveraging ReconAssist, leading retailers can guarantee precision, transparency, and adherence to regulations throughout their payment reconciliation procedures. The advanced reporting and audit trail capabilities ReconAssist empower retailers, keeping them equipped and prepared to tackle any regulatory challenges.

Visit our website to schedule a demo or to find out more about Ecentric’s ReconAssist reconciliation software solution.

- This promoted content was paid for by the party concerned