![]() Semiconductor Manufacturing International Corp (SMIC) has likely advanced its production technology by two generations, defying US sanctions intended to halt the rise of China’s largest chip maker.

Semiconductor Manufacturing International Corp (SMIC) has likely advanced its production technology by two generations, defying US sanctions intended to halt the rise of China’s largest chip maker.

The Shanghai-based manufacturer is shipping bitcoin-mining semiconductors built using 7-nanometre technology, industry watchers TechInsights wrote in a blog post on Tuesday. That’s well ahead of SMIC’s established 14nm technology, a measure of fabrication complexity in which narrower transistor widths help produce faster and more efficient chips. Since late 2020, the US has barred the unlicensed sale to the Chinese firm of equipment that can be used to fabricate semiconductors of 10nm and beyond, infuriating Beijing.

A person familiar with the developments confirmed the report, asking not to be named as they were not authorised to discuss it publicly.

SMIC’s surprising progress raises questions about how effective the export control mechanism has been and whether Washington can indeed thwart China’s ambition to foster a world-class chip industry at home and reduce reliance on foreign technologies. It also comes at a time when American politicians have urged Washington to close loopholes in its Chinese-orientated curbs and ensure Beijing isn’t supplying crucial technology to Russia.

The restrictions effectively derailed Huawei Technologies’ smartphone business by cutting it off from the tools to compete at the cutting edge — but that company is now quietly staffing up a renewed effort to develop its in-house chip-making acumen.

Previously, SMIC has said that its core capabilities stand at 14nm, two generations behind 7nm, which in turn is roughly four years behind the most advanced technology available now from Taiwan’s TSMC and South Korea’s Samsung Electronics. The company has worked with clients on technologies more advanced than 14nm as early as 2020, it said on an earnings call that year.

Blacklisted

China-based MinerVa Semiconductor Corp, which is named as SMIC’s customer in the TechInsights report, showcases a 7nm chip on its website and said mass production began in July 2021, without specifying the manufacturer. Independent analyst Dylan Patel was first to note the report.

Representatives of SMIC and MinerVa didn’t immediately respond to requests for comment.

The Donald Trump administration blacklisted SMIC about two years ago on national security concerns, citing the company’s ties with the Chinese military, an allegation the chip maker has denied. Following Washington’s move, American equipment suppliers have been banned from providing the Chinese company with gear “uniquely required” to produce 10nm or more advanced chips without licences, although it is not clear exactly what the US department of commerce has allowed domestic firms to sell to SMIC since.

US senator Marco Rubio and US congressman Michael McCaul have repeatedly urged the department to tighten export control restrictions pertaining to SMIC to strengthen US security and ensure China is not transferring technology to Russia and helping Moscow evade sanctions.

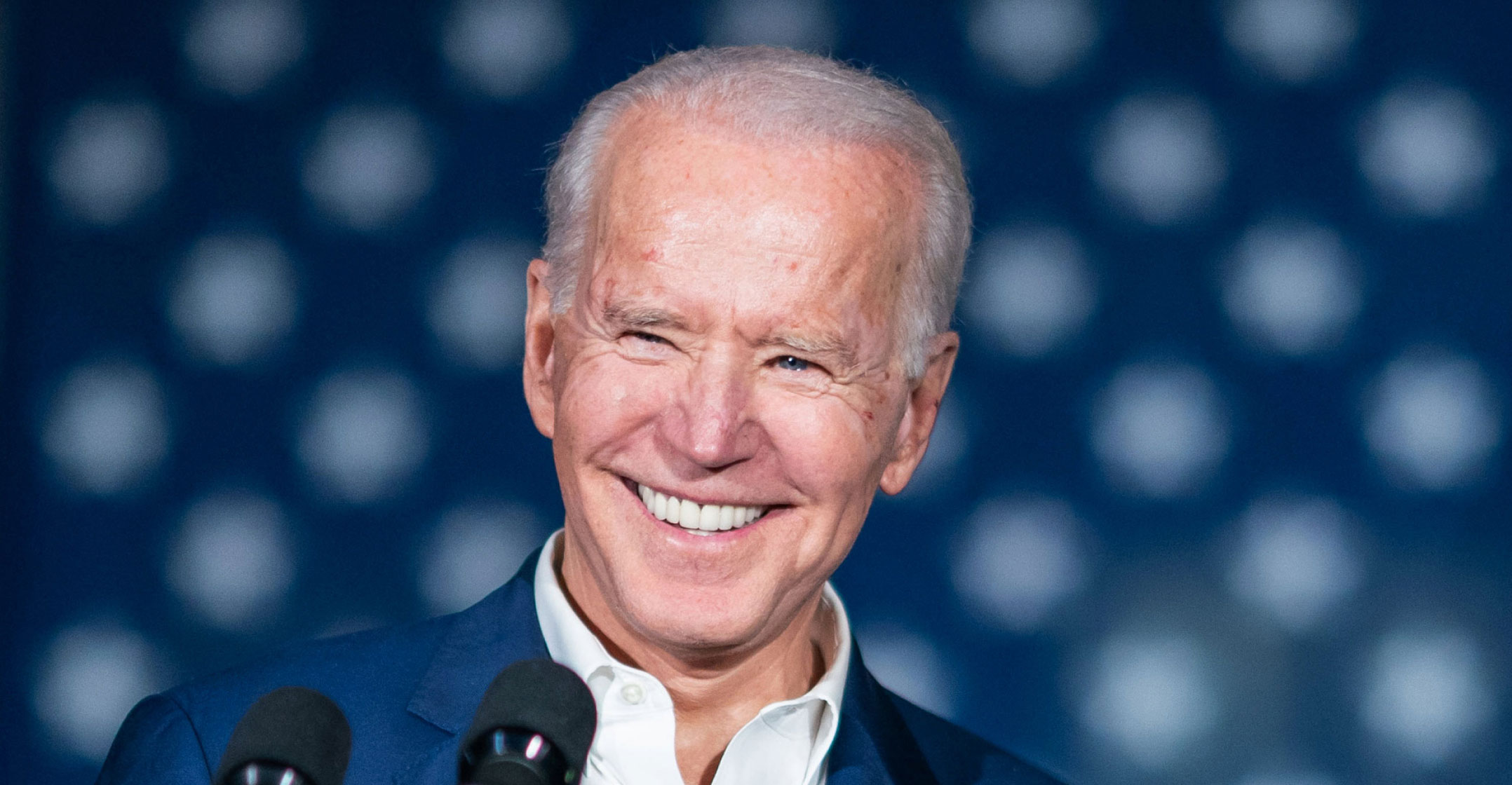

“The Biden administration will continue working to grow and strengthen our cooperation with allies and partners to ensure effective controls on semiconductor production so that we remain generations ahead of competitors in advanced semiconductor technology,” a spokesman for the commerce department said.

SMIC has said that its blacklist status hurts its ability to develop sophisticated technologies. The company’s capability is severely curbed by its lack of access to ASML’s extreme ultraviolet lithography (EUV) systems, which are required to make the most advanced chips that include 5nm and 3nm geometries. The Dutch firm has not shipped a single EUV machine to mainland China because of US pressure on the Dutch government.

The administration of President Joe Biden at one point considered tightening restrictions around SMIC but ruled out any unilateral action to allow for more time to negotiate with other trading partners. Those talks have not borne fruit so far. Washington is, however, pushing ASML to stop selling even less advanced gear to China.

SMIC told analysts in mid-2020 that a large share of the equipment it has for 14nm chips can be used to make more advanced chips and it is seeking to develop more sophisticated technology to improve its profitability. — (c) 2022 Bloomberg LP