US financial firms are pushing for greater clarity on proposed new rules curbing US investments in some China technology sectors which they say are too vague and put the onus of compliance on investors.

US financial firms are pushing for greater clarity on proposed new rules curbing US investments in some China technology sectors which they say are too vague and put the onus of compliance on investors.

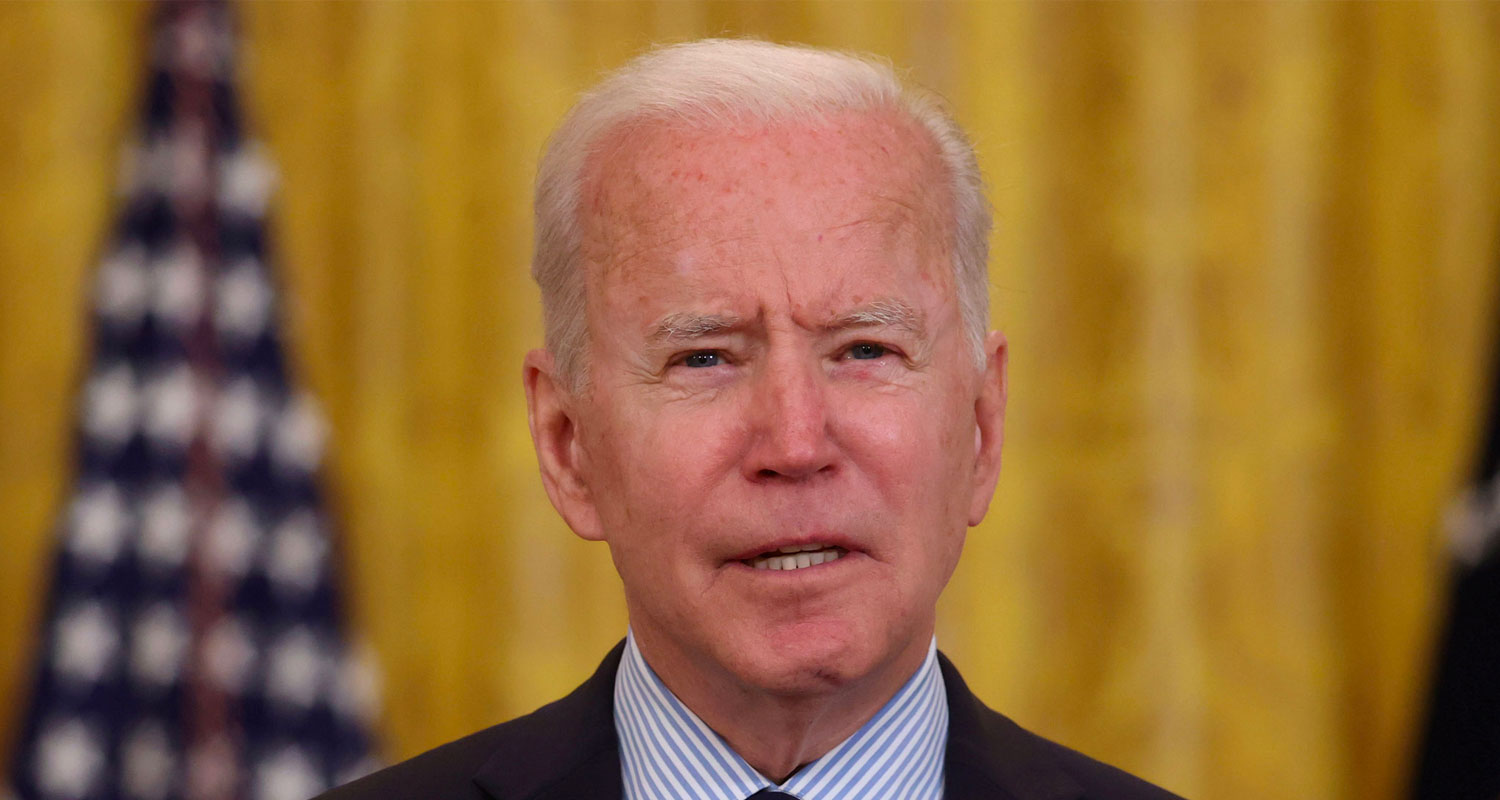

Aiming to protect national security and prevent US capital from aiding China’s military, President Joe Biden issued an executive order last month restricting new US investments in sensitive Chinese technologies. The US treasury department subsequently kicked off a rule-making process to implement the order, and financial firms have been rushing to meet a 28 September deadline to provide input. The rules are expected to be implemented sometime next year.

The proposed rule applies to US persons — including US citizens, residents, businesses and US units of overseas businesses. They must notify the treasury when making certain investments in China in the semiconductors and microelectronics, artificial intelligence and quantum information technologies sectors, and bans other such investments altogether.

In addition to venture capital and private equity firms, hedge funds, banks and potentially funds that track indexes are likely to be affected by the proposal, which financial industry executives and lawyers complain is broad and ambiguous.

Among their key concerns: how the rules would apply to US persons; which specific Chinese entities would be subject to the restrictions; and better defining a proposed exemption for publicly traded securities.

“The scope is pretty broad,” said Timothy Keeler, a partner at law firm Mayer Brown, noting it applies to Chinese entities operating beyond China. “It could apply to companies that are outside of China but are subsidiaries of Chinese companies or controlled by a Chinese person.”

While the US already has restrictions on some Chinese investments in the US and US investments in China, the order creates a new programme. Unlike a process conducted by the Committee on Foreign Investment in the United States, a panel comprising US government agencies, the new programme will not involve case-by-case reviews of investments. And in contrast to sanctions, it does not envisage a list of restricted entities or companies.

Burden

That means investors have to figure out which investments come under the scope of the new rule and how to comply, creating significant compliance costs and legal risks. “That puts a fair amount of burden on an investor,” said a former treasury official.

They may also bar US persons from “knowingly directing” covered transactions by non-US persons. But the threshold for knowledge, or what directing means, is unclear.

“We are hearing a lot about the issue of a US person directing the activities of a non-US person,” said Jen Fernandez, a partner at law firm Sidley Austin. “At what level does ‘directing’ kick in and what does that mean for these non-US private equity funds that may have a dual national sitting as a partner?”

Read: Teardown of Huawei Mate60 Pro shows China’s chip breakthrough

The programme proposes exempting publicly traded securities and index and mutual funds, but financial firms want those securities to be more tightly defined. One key question is whether shares in initial public offerings allocated prior to trading would be carved out.

To address these and other issues, some firms plan to push for a list of restricted entities and investments, similar to a sanctions regime. Former Securities and Exchange Commission chair Jay Clayton, now an adviser with law firm Sullivan & Cromwell, voiced this idea when he told a house of representatives committee on China this month that “Wall Street responds very quickly” to lists of barred entities.

Some sources, though, said they doubted the treasury would go that route, which would reduce the programme’s flexibility and, since the target is cutting-edge technology, quickly become outdated. “That just doesn’t appear to be where this process is heading,” said Keeler.

A treasury spokesman did not respond to a request for comment but said in the proposal that it welcomes input. The rules are necessary because US investments can be exploited to accelerate the development of sensitive technologies that threaten US national security, the treasury and administration have said.

Financial firms say they support the administration’s national security goals but worry about increased liability and the economic costs of restricting capital flows. US-China tensions have already seen acquisitions of Chinese companies by US firms sink almost 60% from January to early August compared with the same period last year.

“Protecting US national security is a paramount obligation of the federal government, but as the treasury states, maintaining global capital flows need not be inconsistent with that,” said Peter Matheson, MD at the Securities Industry and Financial Markets Association, a financial industry lobby group.

Read: China’s iPhone ban appears to be retaliation, US says

Lobbying to contain the rules, however, is politically sensitive, especially because China hawks in the US are pushing bills to make the restrictions tougher. Given the uncertainty, companies may start avoiding the covered sectors altogether, said Fernandez.

“I do think we’re going to see a lot of de-risking,” she added. — Pete Schroeder, Michelle Price and Carolina Mandl, (c) 2023 Reuters