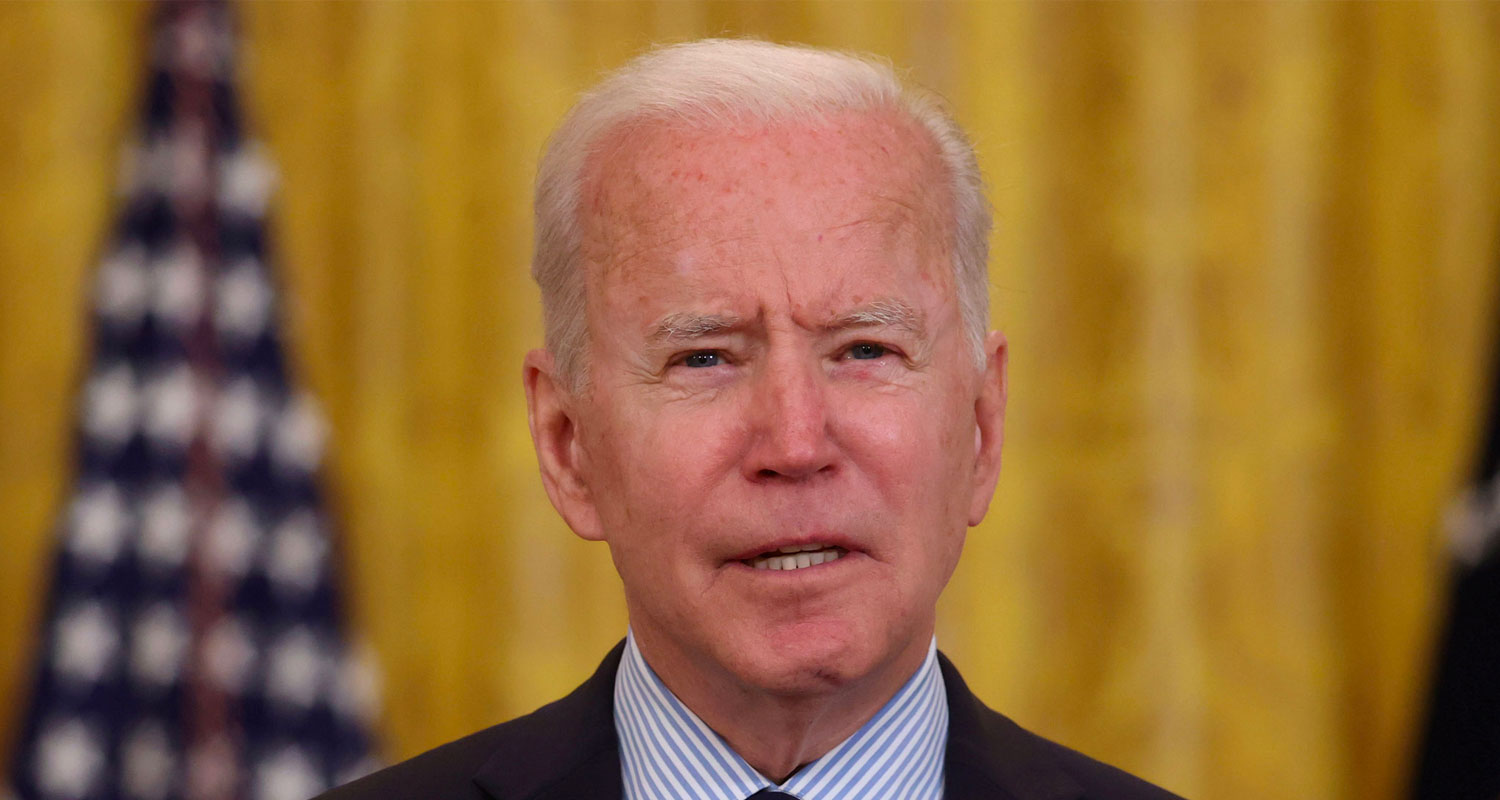

US President Joe Biden has signed an executive order that will prohibit some new US investment in China in sensitive technologies like computer chips and require government notification in other tech sectors.

The long-awaited order authorises the US treasury secretary to prohibit or restrict US investments in Chinese entities in three sectors: semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems.

The administration said the restrictions would apply to “narrow subsets” of the three areas but did not give specifics. The proposal is open for public input.

The order is aimed at preventing American capital and expertise from helping China develop technologies that could support its military modernisation and undermine US national security. The measure targets private equity, venture capital, joint ventures and greenfield investments.

Biden, a Democrat, said in a letter to congress he was declaring a national emergency to deal with the threat of advancement by countries like China “in sensitive technologies and products critical to the military, intelligence, surveillance or cyber-enabled capabilities”.

China said on Thursday it is “gravely concerned” about the order and that it reserves the right to take measures.

The order affects normal operation and decision-making of enterprises, and undermines the international economic and trade order, a statement from the Chinese commerce ministry read.

‘Obstacles’

The ministry also said it hopes the US will respect laws of the market economy and the principle of fair competition, and refrain from “artificially hindering global economic and trade exchanges and cooperation, or set up obstacles for the recovery of the world economy”.

The Chinese foreign ministry said the country was “strongly dissatisfied” with and “resolutely opposes the US’s insistence on introducing investment restrictions on China”, having also lodged solemn representations with the US. China urged the US to fulfil Biden’s promise of no intention to decouple from China or obstruct China’s economic development, the ministry said in a statement.

Read: Binance did monthly transactions ‘worth $90bn’ in banned China market

The proposal focuses on investments in Chinese companies developing software to design computer chips and tools to manufacture them. The US, Japan and the Netherlands dominate those fields, and the Chinese government has been working to build homegrown alternatives.

The White House said Biden consulted allies on the plan and incorporated feedback from Group of Seven nations.

“For too long, American money has helped fuel the Chinese military’s rise,” said senate Democratic leader Chuck Schumer. “Today the United States is taking a strategic first step to ensure American investment does not go to fund Chinese military advancement.”

The regulations will only affect future investments, not existing ones, the US treasury said, but it may ask for disclosure of prior transactions.

The regulations will only affect future investments, not existing ones, the US treasury said, but it may ask for disclosure of prior transactions.

The move could fuel tensions between the world’s two largest economies. The Chinese embassy in Washington said it was “very disappointed” by the measure. US officials insisted the prohibitions were intended to address “the most acute” national security risks and not to separate the two countries’ highly interdependent economies.

Republicans said the order was rife with loopholes, such as only applying to future investment, and was not aggressive enough.

The order will prohibit some deals and require investors to notify the government of their plans on others. The treasury said it anticipates exempting “certain transactions, including potentially those in publicly traded instruments and intracompany transfers from US parents to subsidiaries”.

Republicans said the order was rife with loopholes, such as only applying to future investment, and was not aggressive enough

The Chinese tech industry, once a magnet for US venture capital, has already seen a drastic decline in US investment amid intensifying geopolitical tension.

Last year, total US-based venture capital investment in China plummeted to US$9.7-billion from $32.9-billion in 2021, according to PitchBook data. This year so far, US VC investors only put $1.2-billion into Chinese tech start-ups.

The measure is expected to be implemented next year, a person briefed on the order said, after multiple rounds of public comment, including an initial 45-day comment period. — David Shepardson, Andrea Shalal, Stephen Nellis, Max Cherney, Krystal Hu and Karen Freifeld, with Idrees Ali and Liz Lee, (c) 2023 Reuters